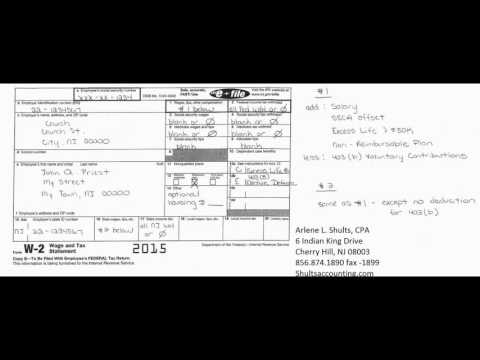

The clergy W-2 is brought to you by Arlene L. Schultz, CPA. Welcome to your clergy W-2 for tax year 2015. This brief video will teach you how to complete the 2015 Form W-2 for your clergy employee who is a resident of New Jersey. At the end of this video, we will show the slight difference for preparing the Pennsylvania W-2. Please pause this video now and take some time to read this document fully, prepare your answers, and then continue the video to join us in examining the actual W-2. Now that you are prepared, enter your information in es A through F. Once that is done, we can examine es 1 through 17 together. Looking first at 1 and our Note number 1, we are entering the total of your employee's wages. Wages include their salary, but they also include other items such as Social Security offset, the group life insurance calculation that you prepared earlier, and any amounts paid under a non-reimbursable plan. You will reduce the total wages by the amount of any 403b contributions made by your clergy person. Note 1 does not include any housing. 2 is the amount of federal income tax you withheld from your clergy person's pay. If none was withheld, es 3 through 11 should be left blank. 12a should have a code C and the calculated amount of excess group life insurance entered. 12b should either have a code E and the amount of the 403B elective deferral in it or simply be left blank. 14 can be left blank, but if you want to, it is acceptable to note the amount of housing paid to the clergy person during the year. It's helpful to the clergy as a reminder, but it's not required. 15 should be noted...

Award-winning PDF software

W-2c instructions 2025 Form: What You Should Know

Filing for an Extension on Form W-2 — IRS Oct 15, 2025 — File the Form W-2 extension application. Form W-2 PDF. Social Security October 15, 2025 — Do you have a Form W-2? Do not file this form as it will be rejected. If you are in a catch-up status and have been paying tax on time, filing your tax return is a good idea. Filing a False or Misleading Form W-4 — Social Security Oct 22, 2025 — Social Security will accept False Information Form W-4 documents submitted by individuals claiming to be a resident of a foreign country, or those of an organization that is organized under foreign law. 2018 Form W-4 (Corrected Wages and Tax Statement) — IRS Oct 29, 2025 — Social Security will accept corrected Forms W-4 if it is signed by an authorized employee of the employer. Filing a False Claim for Refund— Social Security Apr 9, 2025 — You are required to file a claim for refund if any part of the return is incorrect. You can claim one of the three allowable claims: • an overpayment because you were overpaid for Social Security benefits in the last pay period • an underpayment for Social Security benefits for the first 2 pay periods of the preceding 3 consecutive pay periods, or • a failure to pay amounts you owe the United States for Social Security benefits. Social Security Claim for Overpayment. For Individuals Social Security Claim for Overpayment. For Individuals. If you receive an award of overpayment Social Security will not process the claim (see Excerpts from Notice 994) and will require you to complete and send the Corrected Overpayment Claim form (form W-5) along with a letter explaining the overpayment. See the form guidelines for more information about the Form W-5. Social Security will not process the corrected forms until we have received the correction form. Filing a False or Misleading Claim for Refund— Federal Social Security Claim for Overpayment. For Individuals Social Security Claim for Overpayment. For Individuals. If you received a refund or credit for overpayment Social Security will not process the claim (see Excerpts from Notice 994) and will require you to complete and submit the Corrected Overpayment Claim form (form W-5) along with a letter explaining the overpayment. See the form guidelines for more information about the Form W-5.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-3C, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-3C online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-3C by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-3C from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing W-2c instructions 2025